Now we have only one month left to March 29, 2019, the day of Brexit. Whenever possible since the UK referendum in 2016, I have checked out news articles, professional reports. government’s remarks, etc. in English and Japanese. I am listing and explaining the three topics which have seemingly not been confronted in the media, etc., as below.

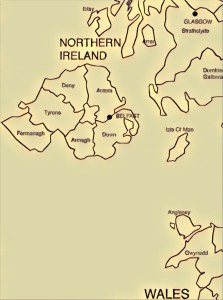

I. Leaving the European Union Customs Union and Avoiding the return of a Hard Border between Northern Ireland and the Republic of Ireland are incompatible.

I have gotten an impression from the media, etc.: in the U.K., Leavers and Remainers have respectively been stick to their own convictions since political activities before the referendum; and agreements between the two factions and those between the EU and UK by the deadline seem a steep path.

In the first half of last year, I felt such steepness is due to the Northern-Southern border. And I have come to feel so stronger, last autumn when there arose much news about the Brexit backstop – a safety net in order that the NI and the ROI will maintain the current open border, under the 1998 Good Friday agreement which decided not to make physical facilities on the border, in case no formal deal between the EU and the UK can be reached on trade and security arrangements by the end of transition period, i.e. the end of the year 2020.

In English there is much news articles plainly explaining the border question, and not a few ones whose precondition is the above incompatibility. However, there seems no article which confronts the incompatibility itself. In Japanese, there seems no such news articles other than the one written by a senior researcher of a Japanese think tank who I do not know in person.

That article says the entire Brexit necessitates the hard border – such a tight border control that Japan has done as a distinct economic area; and you need to give up the entire Brexit if you maintain the current open border, which means you need to stay in the EU customs union as you belong to the same economic area as the EU. I agree to it. I have an overall impression that concerned people have actually continued to find some compromise plan because it would have been all for nothing if they had said this clearly in public. However, eventually, nothing comes from nothing.

The incompatibility eventually leads just to “some people choose one of the two”. There are options such as another referendum, a resolution of the House of Commons, a snap election, etc. In the first place, the referendum, one of the campaign promises in the 2015 general election, was conducted in 2016 and followed by a state of seemingly senseless chaos. So, the least unreasonable would be another referendum which confirms whether or not the result of the referendum in 2016 is UK citizens’ will in reality.

Fundamentally, not only referendum but also voting itself tends to be greatly affected by political winds, not decided by the content of the subject on which the judgement of the people was sought. And in 2016, Leave won by a very narrow margin, despite this result will turn over the status quo of the whole UK. If the result were Remain, i.e. maintaining the status quo, a very narrow margin would not matter. But the result was the turnover. What are convincing reasons to avoid another referendum under democracy, which ask people whether it is OK to really exit the EU on the basis of the narrow margin? I have not understood such reasons, while I saw “referendum should not be carried out twice because we had better preserve the credibility of the referendum”, etc. Most of UK citizens will be convinced, if another referendum confirms their judgement and a hard Brexit comes true.

II. The state of things in electoral districts of MPs who left the Labour or the Conservative parties.

As of 21 February, eight Members of Parliament have left the Labour, the largest opposition party, due to their dissatisfaction with its leader’s vague attitude toward Brexit, anti-Semitic attitude, etc. On the other hand, three MPs have left the Conservative, due to their dissatisfaction with the government’s catastrophic handling of Brexit. A total of these eleven members will not join the opposition Liberal Democrats, but form an independent group which aims to conduct another referendum (seemingly similar to my above thought). We can think in general that their actions are based on their concerns that they lament the UK as parliamentarians, or are related to circumstances of constituency to whom they owe many things.

The eight ex-Labours [district/county] are Coffey [Stockport/Greater Manchester], Smith [Penistone and Stocksbridge/South Yorkshire], Shuker [Luton South/Bedfordshire], Gapes [Ilford South/Greater London], Umunna [Streatham/Greater London], Leslie [Nottingham East/Nottinghamshire], Berger [Liverpool Wavertree/Merseyside], Ryan [Enfield North/Greater London]; the three ex-Conservatives Soubry [Broxtowe/Nottinghamshire], Allen [South Cambridgeshire/Cambridgeshire], Wollaston [Totnes/Devon].

According to a UK university’s research, for example, in Coffey’s Stockport, Leave-Remain difference were marginal, and Remainers increased in proportion to house prices. We can think that there are not a few people who have middle-price houses, voted Leave in 2016, but converted themselves to Remainers, while there are usually more middle-price house owners. Would this situational change urge the ex-Labour and ex-Conservative members to secede from the party and to try to conduct another referendum? When we see MPs’ voting behaviors at resolutions in the House of Commons, there must be cases in which it is useful to analyze not only house prices but the state of things in electoral districts.

III. The City of London does not prefer Jeremy Corbyn’s policies.

Although the ruling party achieved a great victory in the 2015 general election, it could not have been intrinsically strange if approval for the party had dropped significantly in the UK where regime changes by two largest parties have already taken roots, considering chaos which has continued so far and will continue. And the above attitude of the Labour leader seems to rather show his favor on soft Brexit.

However, in the media, etc., it has been said by and large that Corbyn’s Labour government with a strong left-wing flavor and its public policy such as re-nationalisation of public utilities and wealth tax are undesired, and are feared more than hard Brexit. The former would expand budget deficit and cause a sharp rise of inflation rate, which would lead to government bonds’ decrease in demand and long-term government bonds’ decrease in price. The latter would be an income tax hike towards people with over eighty thousand pounds, and would lead to the people’s escaping abroad and the UK’s revenue decline. The City is said to be on its guard against such policies. If I dare to say, its guard might not be off-base.

For example, concerning the re-nationalisation, we need to take the following into consideration: the UK government deficit-to-GDP ratio is not extremely bad (0.875 in 2017); and Tony Blair’s Labour government so positively expanded the PPP (public-private partnership) including the PFI (private finance initiative) that re-nationalisation, which means banks, equity investors and other private financiers being forced to take a haircut on their investments, is not wanted by the City. On the other hand, in many ages and countries, there have often been policy differences between two largest parties, which need to be tackled at any time taking considerable contents such as the above two into consideration.

It should be noted that immediate news coverage and possible analyses shortly after it are of course important. And I usually respect the importance to sort long processes, significant effects on international society, complicated and mysterious affairs of politics and economy, etc., at each turning point of major incidents. However, I picked up the above three points, on the assumption that I write about Brexit just this time – after countless news articles, researches, etc. were already published.

Taku Nakaminato, World Solutions LLC

24 February, 2019

The above is a provisional English translation of “Brexit Vol.13“.

P.S. I posted the above at around 5 pm (JST). Thank you for coming, many English readers.

Around 2 pm, 25 February Today I just added the following hyperlinks:

NOT JUST ANTISEMITISM: CORBYN’S BREXIT PROBLEM IS ALSO A DISASTER FOR JEWS

BRITISH PRIME MINISTER THERESA MAY COMMENTS ON LABOUR PARTY ATTRITION

Ian Austin quits Labour blaming Jeremy Corbyn’s leadership

Ian Austin says he couldn’t look Jewish father ‘in the eye’ if he remained in Labour party

Corbyn told: change course before it’s too late for Labour