All the below links and excerpts (incl 5 pictures) are in English.

Comprehensive and Progressive Agreement for Trans-Pacific Partnership – National Interest Analysis @ NZ MFAT (PDF; 03/2018) You can check out the below pictures (Tables, etc.) as well.

p4 Table 1.1: Exports from New Zealand to new FTA partners

pp5-6 Table 1.2: Estimated impact of CPTPP

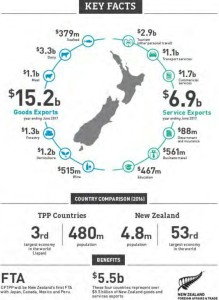

p8 KEY FACTS, etc.

p16 Japan is New Zealand’s fifth largest export market and it is a high value one for exporters. In the year to June 2017 two-way trade stood at NZ$7.9 billion. New Zealand exports to Japan were NZ$4.0 billion, accounting for 5.5 percent of our total exports. The trading relationship is highly complementary with New Zealand supplying food and industrial materials, such as wood and aluminium, and Japan exporting finished industrial goods and machinery to New Zealand. The CPTPP will help New Zealand agriculture exporters in particular overcome high MFN tariff rates into Japan. Japan is also New Zealand’s fifth largest source of foreign direct investment, with significant investments in the forestry sector. Services exports are another big part of our trading relationship, with Japan a top-five source of students and tourists.

p19 … There are already competitors that enjoy lower barriers to trade relative to New Zealand businesses in key CPTPP markets (e.g. Australia in Japan) and more will follow as other free trade agreements are realised (e.g. the EU-Japan FTA). …

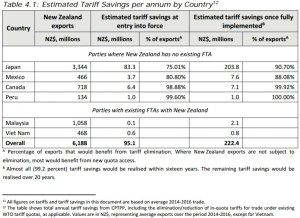

p22 Table 4.1: Estimated Tariff Savings per annum by Country

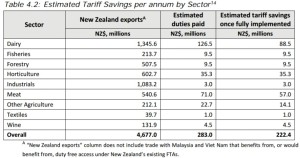

p23 Table 4.2: Estimated Tariff Savings per annum by Sector

pp23-24

• At entry into force (Year 1): tariffs eliminated on NZ$1.4 billion of New Zealand exports currently subject to tariffs, including many horticultural and forestry goods, a number of dairy products, some wine, many manufactured products, and much fish and seafood. Specific product examples include such items as: Japan (kiwifruit, squash); Canada (wine); Mexico (mussels, kiwifruit, milk albumin); and Peru (buttermilk powder). As a result, 79.8 percent of New Zealand exports to these new FTA markets would enter duty free on the day the CPTPP enters into force, with estimated tariff savings for New Zealand exporters of NZ$95.1 million.

• By the 5th year after entry into force (Year 6): tariffs eliminated on an additional NZ$111.2 million of New Zealand exports currently subject to tariffs, including: … Japan (hoki and other frozen fish, carrot juice, sausages and mandarins) … 2.4 percent of total current New Zealand exports to … 82.2 percent … Estimated total tariff savings in the fifth year after entry into force are NZ$148.1 million.

• By the 10th year after entry into force (Year 11): tariffs eliminated on an additional NZ$175.0 million … Japan (tongues, hides, bluefin tuna and apples) … 3.7 percent … 85.9 percent … NZ$186.9 million.

• By the 15th year after entry into force (Year 16): tariffs eliminated on an additional NZ$220.8 million … Japan (cheese, sawn wood and offal) … 4.7 percent … 90.6 percent … NZ$220.6 million.

• When fully phased in: tariffs eliminated on an additional NZ$71.9 million of New Zealand exports currently subject to tariffs. The total tariff savings from the CPTPP are estimated to be NZ$222.4 million per year at full implementation, not taking account of dynamic impacts.

pp24-25

• Tariff reductions: Tariffs on an additional NZ$207.1 million of goods exports would be significantly reduced, but not eliminated, allowing for improved market access. This includes beef exporters that would benefit from a 77 percent reduction in Japan’s tariff for beef. This tariff would be reduced from the current 38.5 percent duty to 9 percent over sixteen years, with an initial sharp cut at entry into force, to 27.5 percent. There will be a transitional volume-based safeguard applying to all CPTPP beef imports into Japan, set above current trade levels, with a growth rate. The safeguard will be abolished by Year 20 at the earliest. The new CPTPP safeguard would remove the potential for Japan’s WTO beef safeguard to be applied to New Zealand’s exports. That safeguard was exceeded in 2017 meaning that a higher ‘snap-back’ tariff of 50 percent is being applied to New Zealand exports through to 31 March 2018 placing New Zealand beef exporters at a significant disadvantage to other countries (e.g. Australia) that have an FTA with Japan. This outcome is the best outcome that Japan has agreed in a FTA to date, and would help re-establish a level playing field with Japan’s largest beef supplier, Australia, after the Japan-Australia Economic Partnership Agreement entered into force in early 2015.

Japan will also reduce the tariff for ice-cream by two-thirds, from 21 percent today to 7 percent over six years, opening up new export opportunities given the significantly reduced tariff.

p26 Table 4.3: Estimated Total Volume of CPTPP Quota Access available to New Zealand Exporters

By Year 10 of the CPTPP Agreement entering into force:

• Japan will provide 40,200 MT of predominately CPTPP-wide access, with 14,000 MT on priority products for New Zealand including butter and powders. Japan is also eliminating tariffs for most cheese over sixteen years.

p27 … For country-specific access into Japan, tariffs on WTO trade are eliminated over 21 years after entry into force, with an 80 percent reduction in the first 11 years. …

… Given the scale of some of the tariff benefits from CPTPP that would, in this scenario, accrue to New Zealand’s competitors inside CPTPP, but not New Zealand – e.g. Japan’s reduced beef tariffs, or tariff elimination on Japanese cheese tariffs – New Zealand exporters would likely lose significant market share to other CPTPP exporters if New Zealand were not part of CPTPP.

p53 … The CPTPP also builds on the opportunities New Zealand businesses secured under the WTO Agreement on Government Procurement (GPA), with some modest improvements to access in Canada, Japan and Singapore (e.g. additional entities and coverage of private-public-partnerships). …

pp86-87 Export restrictions – food security

In Article 2.26, Parties acknowledge that countries may temporarily apply an export prohibition or restriction on foodstuffs where there is risk of a critical shortage as set out in Article XI of the GATT 1994 and Article 2.1 of the Agreement on Agriculture. Further to this, the Parties agree that if a CPTPP country is a net exporter of a foodstuff and imposes an export prohibition or restriction on the foodstuff from another CPTPP country in these circumstances, it must notify all of the other Parties before the measure comes into force. Notification must include the reason that the measure was imposed or maintained, how the measure is consistent with the GATT and any alternative measures the Party considered imposing. Any Party that has a substantial interest as an importer of that foodstuff may request consultations with, or data relating to the critical food shortage from, the Party imposing or maintaining the measure.

Any measure that is notified under this procedure should ordinarily be removed within four to six months. If a Party is considering extending the measure for longer than this, further notification must be provided to the other CPTPP countries. Measures may only be continued for longer than twelve months if all other Parties that are net importers of the relevant foodstuff have been consulted. A measure must be discontinued immediately if the critical shortage, or threat of critical shortage, no longer exists.

These measures may not be applied to food purchased for non-commercial humanitarian measures.

p95 Global safeguards

pp105-107 Wine and Distilled Spirits Annex

pp204-205 Table 7.1: Summary of impacts

p207 New Zealand exporters have direct experience of this kind of competitive displacement caused by being on the outside of preferential access enjoyed by competitors. For example:

• Since the entry into force of the Australia-Japan FTA, New Zealand beef exports to Japan have dropped by over 25 percent, with New Zealand exporters losing market share to their Australian competitors who are only beginning to enjoy tariff preferences under the FTA.

• Following the entry into force of the Korea-US FTA, US beef exports increased 25 percent. New Zealand exports declined by almost NZ$50 million. The US’ share of the Korean cheese import market has also grown from 41 percent to 74 percent.

• Until the entry in force of the New Zealand-Korea FTA, kiwifruit exporters paid a 45 percent tariff on kiwifruit. Their Chilean competitors enjoy duty-free access.

• Prior to the NAFTA agreement being signed by Canada, Mexico and the US in the 1990s, New Zealand was a significant supplier of dairy products to Mexico. Since Mexico eliminated tariffs for US dairy products, New Zealand’s share of Mexico’s cheese imports declined from 20 percent to 4 percent, and our share of milk powder imports from 25 percent to less than 10 percent.

ImpactEcon et al modelled the economic impact of the CPTPP by first estimating how New Zealand’s economy would be expected to develop as part of the global economy in the absence of CPTPP, and comparing this to the case where CPTPP liberalised trade in goods and services in four areas. The result of the CGE model takes account of the complicated adjustments that might take place in an economy following new trade flows and resource allocation. The four ways in which CPTPP was assumed to liberalise trade were:

• Reductions in tariffs and quota barriers on goods trade.

• Reductions in non-tariff measures on goods trade.

• Improved trade facilitation measures.

• Reductions in barriers on services trade.

pp207-211

pp221-225 8 The costs to New Zealand of compliance with the treaty

pp239-243 Overview of the suspensions

Latin American Perspectives on the Trans-Pacific Partnership (TPP) (PDF; 09/02/2016) | NEW ZEALAND CENTRE FOR LATIN AMERICAN STUDIES, School of Cultures, Languages and Linguistics, University of Auckland

“Is the TPP a mega-NAFTA that will devastate Mexico?” Daniel Villafuerte Solis, The Centre for Advanced Studies in Mexico and Central America (CESMECA)

The agro-food sector, the most hard-hit by NAFTA, could suffer a new beating under the TPP. To put this into context, let us remember some figures from the Bank of Mexico: in 2014, the Mexico had a trade deficit for agro-food and agro-industrial products of US $2.593 billion, an amount equivalent to 40% percent of the budget assigned that year to the Secretariat of Agriculture, Livestock, Rural Development, Fisheries and Food (SAGARPA).

The figures for imports by sector are frightening: between 2010 and 2014, imports of milk, diary, eggs and honey grew by 57.% totalling more than 2 billion dollars in 2014; meat and edible meat offal imports grew by 42.5% to $4.596 billion; cereals grew by 31.6% reaching $4.259 billion; and imports of legumes grew by 15.3%. Together, imports in these four sectors grew from $10.751 billion to $14.342 billion, an increase of 33.4%.

“What is the Trans-Pacific Partnership all about?” Alejandro Villamar, Mexican Action Network on Free Trade (RMALC)

To give just some examples of recent analyses of the potential impacts on food sovereignty, agriculture and health, the TPP would result in illegal contamination of foodstuffs by genetically modified organisms, and a new report questions the rules of food security and animal health in the TPP (http://goo.gl/SKKbqe).

“The TPP: Bad news for farmers and agriculture” Karen Hansen-Kuhn, Institute for Agriculture and Trade Policy

The bad news is that the TPP expands many of the worst features of NAFTA. Mexican farmers were devastated by the dramatic increase in corn exports from the U.S. under NAFTA. This didn’t help most U.S. farmers, who were pushed to expand exports to compensate for low prices and declining public support. It led to increasing corporate concentration in agricultural production, leaving farmers with fewer options of where to buy and sell their goods, and a decline in the number of family farmers in all three NAFTA countries. This unfair market will be deepened under TPP. …

No More Business-as-Usual: Where to Now for International Trade? (PDF; 07/2017) | David Hall @ Auckland University of Technology

Departmental Disclosure Statement – Trans-Pacific Partnership Agreement (CPTPP) Amendment Bill (PDF; 21/06/2018)

Economic Gains and Costs from the TPP – Review of Modelled Economic Impacts of the Trans Pacific Partnership (PDF; 2014) | Sustainablity Council of New Zealand

Submission of the Building and Wood Workers’ International (BWI) to the Foreign Affairs, Defence and Trade Committee (Parliament of New Zealand) regarding International treaty examination of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (PDF; 04/2018)

Personal values and support (or not) for the Trans-Pacific Partnership Agreement (PDF; 03/2018) | Jono Bannan, Simon Kemp and Zhe Chen @ University of Canterbury

The Benefits of Trade (PDF) | NZIER

The Trans-Pacific Partnership (TPP) (PDF; 09/2011) | NEW ZEALAND COLLEGE OF PUBLIC HEALTH MEDICINE

New Geopolitical Developments in the South Pacific: The Cases of Australia and New Zealand (PDF; 02/2018) | Dr. Anne-Marie Schleich @ ISPSW

TPP-11: Achieving Growth in a Time of Trade Uncertainty (27/08/2018) | Dr Luke Hurst @ Australian Institute of International Affairs

The TPP Investment Chapter & Investor State Arbitration in Asia & Oceania (PDF) | Dr Luke Nottage @ Sydney Law School

Can the Trans-Pacific Partnership multilateralise the ‘noodle bowl’of Asia-Pacific trade agreements? (PDF; 03/2016) | Jeffrey D. Wilson @ Perth USAsia Centre

THE TRANS-PACIFIC PARTNERSHIP: COPYRIGHT LAW, THE CREATIVE INDUSTRIES, AND INTERNET FREEDOM (PDF; 10/2016) | DR MATTHEW RIMMER (@ QUT) @ THE SENATE FOREIGN AFFAIRS, DEFENCE AND TRADE REFERENCES COMMITTEE

The TPP: Truths about Power Politics (PDF; 08/2017) | Malcolm Cook @ ISEAS – Yusof Ishak Institute

Trading Down: Unemployment, Inequality and Other Risks of the Trans-Pacific Partnership Agreement (PDF; 01/2016) | Jeronim Capaldo and Alex Izurieta with Jomo Kwame Sundaram @ GLOBAL DEVELOPMENT AND ENVIRONMENT INSTITUTE, Tufts University

Trade Implications of the Trans-Pacific Partnership for ASEAN and Other Asian Countries (PDF; 08/2013) | Alan V. Deardorff @ The University of Michigan

TPP Countries Sign New CPTPP Agreement without U.S. Participation (PDF; 03/09/2018) | Ian F. Fergusson & Brock R. Williams @ CRS Insight

The Trans-Pacific Partnership Negotiations and Issues for Congress (PDF; 08/21/2013) | Ian F. Fergusson, William H. Cooper, Remy Jurenas, Brock R. Williams @ Congressional Research Service (@ Cornell ILR)

Negotiations for a Trans-Pacific Partnership Agreement (PDF) | William Krist (Edited with an Introduction by Kent Hughes) @ Wilson Center

The Trans-Pacific Partnership: New Paradigm or Wolf in Sheep’s Clothing? (PDF; 01/01/2011) | Meredith Kolsky Lewis @ Boston College International & Comparative Law Review

TPP-11 Agree on List of Suspended Provisions (PDF; 11/13/2017) | Charles Akande @ Geneva Watch

The Trans-Pacific Partnership Deal (TPP): What Are the Economic Consequences for In- and Outsiders? (PDF; 12/2015) | Rahel Aichele and Gabriel Felbermayr @ CESifo Forum

cf.

New Zealand Vol.15 / Trans-Pacific Partnership #TPP Vol.1