All the below links and tweets are in English.

取り急ぎ以下貼っておきます。

World Vol.293 (Russia’s invasion of Ukraine)

World Vol.292 (Russia’s invasion of Ukraine)

World Vol.291 (Russia’s invasion of Ukraine)

World Vol.290 (U.S., etc. – miscellaneous)

World Vol.289 (Russia’s invasion of Ukraine)

World Vol.288 (Russia’s invasion of Ukraine)

World Vol.287 (U.S., etc. – miscellaneous)

World Vol.286 (Russia’s invasion of Ukraine)

World Vol.285 (economy – Russia, etc.)

World Vol.284 (Russia’s invasion of Ukraine – NATO, EU, G7)

World Vol.283 (Russia’s invasion of Ukraine)

World Vol.282 (U.S., etc. – fertilizer, etc.)

内容例(各回ツイートもご覧ください)

以下、順に、

293:@PhillipsPOBrien,@TheAtlantic

292:@War_Mapper,@sentdefender

291:@KofmanMichael,@bonnieberkowitz,@arturgalocha,@washingtonpost、@anneapplebaum,@TheAtlantic、@amyfeldman,@Forbes、@wojcikrp,@cepa

290:@brynrosenfeld,@kelly_zvobgo,@danielposthumu2,@monkeycageblog、@CNN、@AdamBienkov,@FT、@AFP,@visegrad24,@AlexandruC4

289:@TheStudyofWar、@andrewlohsen,@WarOnTheRocks

288:@ABC

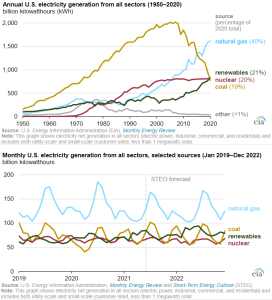

287:@EIAgov,@hausfath

286:@ABC

285:@RTPerson3,@njtmulder,@ForeignAffairs、@elpaisinenglish,@AngelUbide、@CNBCnow

284:@nytimes、@NATO、@eucopresident,@EUCouncil,@POTUS、@dailybeast,@djrothkopf,@New_Narrative

283:@Newsweek

282:@ElizabethElkin,@business、@Hedgeye

本稿:@qz、@Reuters、@reason、@KitcoNewsNOW

「Russia」及び「palladium」「nickel」を入力検索して出て来たツイート

"Some of the commodities Russia exports to the U.S. … also feed into the prices," @SPGlobalRatings Chief U.S. Economist Beth Ann Bovino says. "Cars also rely on palladium from Russia, neon… that stuff isn't going to be coming through any time soon." https://t.co/Jb7k9tf4PH pic.twitter.com/f19fQynIx2

— Yahoo Finance (@YahooFinance) April 12, 2022

Sabrin Chowdhury speaks with @BloombergTV on #Metals & the affect on the market due to the #Russia–#Ukraine crisis. Watch the interview here: https://t.co/qTeZVkSznP#ConnectedThinking #Nickel #Aluminum #Copper #Palladium #Commodities #Evbatteries #Greentransition #Geopolitics pic.twitter.com/bEGSOnWKBx

— Fitch Solutions (@FitchSolutions) April 12, 2022

Recession risks and inflation fears keep gold price volatile, palladium price driven by Russia supply questions https://t.co/ue3lbJWuDn #kitconews #gold #silver #metals #finance #investing #mining #economics

— Kitco NEWS (@KitcoNewsNOW) April 11, 2022

Many German companies rely on a steady supply of other Russian exports, particularly raw materials such as nickel, palladium, copper and chromium. #Germany, stop paying Russia for #Ukrainian blood. #BoycottGermany

Nickel Germany's other big Russian import https://t.co/cqMZc5jryK

— PeaceInUkraine (@MikeValInvest) April 13, 2022

Palladium Steadies After 5% Jump on Russia Supply Risks https://t.co/sbqllFYP3E

.#bullion #business #centralbank #disruption #embargo #energy #gold #goldmarket #market #metals #metalsmarket #palladium #pressure #spot #trade #wealth pic.twitter.com/vd6GBXN1d1— Armin Hamidian (@arminhamidian) April 13, 2022

SocGen to quit #Russia with sale of #Rosbank stake to oligarch #Potanin

Rosbank will join the business empire of Potanin, who is the biggest shareholder in #NorilskNickel (https://t.co/Gf00IdC28C), the world's largest producer of #palladium &refined nickel https://t.co/vhRofLLi3q— Roger Edde روجيه إدّه (@EddeRoger) April 11, 2022

"Dentists are now paying far more for palladium than they used to but are not being reimbursed for their additional costs under the national medical insurance system."https://t.co/SpllsEwbJp

— Louis Bachour (@louis_bachour) April 10, 2022

The Wall Street Journal: Palladium and platinum prices jump after London market blocks Russian precious metals https://t.co/mCFLpHdUiE #ETF #tracker

— ETF (@ETF_Tracker) April 10, 2022

The London Platinum and Palladium Market (LPPM) has said it will block Russian refineries from selling the two metals in the London market, the world’s largest.

Any mentioned about gold and silver ?

Russia produces 11% of the worlds gold and 5% of the worlds silver. pic.twitter.com/utj8WniS7e— Wall Street Silver (@WallStreetSilv) April 10, 2022

London will panic. They even excluded Palladium earlier.https://t.co/EFbfgxOQWo

— Mats ☮ Nilsson (@mazzenilsson) April 9, 2022

Palladium and platinum on Friday.

"Russia's Norilsk Nickel produces 25-30% of the world's palladium supply and about 10% of platinum, which is also used to curb vehicle emissions as well as in other industries and to make jewellery."https://t.co/optX33XSYl

— The Passenger (@gordonschuecker) April 9, 2022

Amplats CEO says carmakers looking for palladium after Russia sanctionshttps://t.co/ncrHcQMJ6G pic.twitter.com/fT8KlSiPJX

— Stillwater Critical Minerals (@Stillwater_CM) April 6, 2022

https://twitter.com/rand0703/status/1511560993767243777

Automotive industry experts predicted price hikes for new vehicles would come soon after they saw the prices of aluminum, nickel and palladium blast off in recent weeks as Russia's February 24 invasion of Ukraine appeared more and more imminent. https://t.co/aoUOtVApIv

— CBS News (@CBSNews) March 15, 2022

https://twitter.com/karun_f7/status/1500856665280692225

#Industrynews from @mining @Norilsk_Nickel puts #nickel and #copper on the #blockchain with their new exchange-traded commodities#Mining #StocksToWatchhttps://t.co/DbVCeGUodK

— Metal Energy (@MetalEnergyCorp) June 18, 2021

Russia’s @Norilsk_Nickel said on Tuesday it expects it will be another week before it has an idea of when it can restart two waterlogged mines in Siberia. https://t.co/9qed4SzbvW

— mining (@mining) March 9, 2021

@Norilsk_Nickel partially suspended operations at its Oktyabrsky and Taimyrsky mines in Siberia because it had detected an inflow of water underground, sending shares of the Russian metals miner down more than 6%. https://t.co/fEmDB8MRYN #StocksToWatch

— mining (@mining) February 24, 2021

PLS RT@Norilsk_Nickel , Russian #Mining Giant Admits to Polluting the #Arctic With #wastewater

seen on @EcoWatch https://t.co/RriCFBhV1a@DrawingUnited

aims at exposing these reckless #industrial practicesJoin us today > https://t.co/62M3DpvJZR pic.twitter.com/tUVDp7SYTk

— Drawing United (@DrawingUnited) July 7, 2020

#Palladium is up 368% since 2016 & about 70% in the last year. Clearly demand is outstripping supply. @Norilsk_Nickel is the worlds largest producer of the metal. The shares are currently valued at $34.45 with a #dividend yield of 8.96 & a price to earnings ratio of 12.75 pic.twitter.com/jkYZcge7wI

— jwalker (@11jwalker) February 12, 2020

Russian nickel and palladium mining and smelting giant Norilsk Nickel announced plans to pump in more than $12 billion to boost its production capacity over the next five years. .@Norilsk_Nickel #investment #mininggiant #nickel https://t.co/zcbnSnM4MA

— Ebru Karaşın (@Ebru_Karasn) December 11, 2018

Norilsk Nickel and the United Nations Industrial Development Organization have signed a joint declaration to support environmentally-sound technologies in the metals industry, Nornickel says | https://t.co/5WgnOeEXxY @Norilsk_Nickel @UNIDO #sustainablemining #futureofmining pic.twitter.com/2ImAxdXvSM

— International Mining (@im_mining) November 11, 2019

.@Norilsk_Nickel, #SeverMinerals and #Norilsknikelremont have recently completed the relining of a #SAG mill at the company's #Talnakh concentrator in #Russia using @metsogroup's #Megaliner concept https://t.co/vNVeAJZMsM #futureofmining #comminution #minemaintenance pic.twitter.com/U2ZNj15dO9

— International Mining (@im_mining) February 21, 2019

Trust between industry and #indigenous #communities – from myth to reality. Read the examples of the major companies in the primary industry, such as @RioTinto, @Glencore, @bhp, @ALROSA_official, @Norilsk_Nickel: https://t.co/pzIu7spIze pic.twitter.com/BEJvoz8uQJ

— De Coutre (@DeCoutre) January 19, 2021

let us look at palladium https://t.co/pLVot9fZne

let us not forget that Russia is the no.1 producer of Palladium a transition metal. dumb fucks Claudia van Leyen en co.— Godfrida Everdine Schreurs (@GEGryphon) April 9, 2022

https://twitter.com/barnettenergy/status/1512470494984945664

Every word is a hashtag! Don’t miss this interesting discussion! #Russia, #Ukraine, #inflation, #nickel, #silver (Rafi Farber & Ran Gavriely) https://t.co/fe5aqNiQnL via @ArcadiaEconomic @RafiFarber @GavrielyRan

— Silver Babe #GotSilver? (@yarrs) March 21, 2022

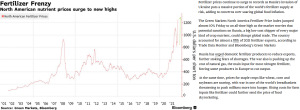

Prices of principal commodities of Ukraine and Russia have risen sharply (Nickel, wheat, corn, platinum, gas, oil…). pic.twitter.com/BjiTTNOQTq

— Philipp Heimberger (@heimbergecon) March 20, 2022

Germany needs to transform not only its energy but also its industry and raw material supply for it. Big challenge…

Russia's share in Germany's selected raw material imports in 2020

Natural gas: 55%

Coal: 46%

Nickel: 44%

Titanium: 41%

Oil: 34%

Palladium: 18%

via @derspiegel pic.twitter.com/3OQQTp1arT— Alper Üçok (@AlperUcok) March 18, 2022

https://twitter.com/SStapczynski/status/1505464557544046593

The immediate rupture of Russia’s invasion of Ukraine is savage.

The supply of basic commodities, from wheat to nickel to titanium to oil, has been disrupted. The West is doing everything it can to “cancel” Russia from the global economic system https://t.co/RRARh3Sfmt pic.twitter.com/AbJc21qrPI

— Bloomberg Opinion (@opinion) March 24, 2022

Electric-vehicle makers are facing problems over the supply of nickel needed to make batteries since Russia is one of the world’s biggest producers https://t.co/egqbAvGpMm

— Bloomberg (@business) March 30, 2022

https://twitter.com/calxandr/status/1513813954740506629

https://twitter.com/calxandr/status/1509103260841672708

Tesla needs to reassure shareholders that it is no longer sourcing nickel and aluminium from Russia. https://t.co/5nl9VEE0Ye

— Neil Heard (@NeilHeard1) April 6, 2022

Global nickel smelting rose in March (even in Russia), satellite data show https://t.co/YKxVqyormt

— Ernest Scheyder (@ErnestScheyder) April 6, 2022

Following Russia's invasion of Ukraine and the ensuing nickel volatility and trading issues in the London Metal…Learn more in our insight >>>

#londonmetalexchange #metals #Nickel #Russia #sanctions #steel #UkraineCrisishttps://t.co/QlZC1VbH7y

— QUATRO International Inc. (@QuatroInc) April 7, 2022

Nickel, which is used in the cathodes of the most common EV batteries, has seen extreme price spikes following Russia's invasion of Ukraine. But new nickel-mining capacity set to come online later this year could help costs come back down: https://t.co/LjVI9tv2IY

— Grace Donnelly (@gddonnelly22) April 13, 2022

"another..source of nickel and cobalt that could be counted on…Unfortunately, this source happens to be Cuba, and American companies have been forbidden by law to do business with Cuba for most of the last 60 years."https://t.co/ZHkBaNf5K4

— Lone Candle (@Lone_Candle) April 13, 2022

Nickel from #Tanzania is well placed to supply a global automotive industry seeking alternative sources to Russia to feed the transition to electric vehicles, says Kabanga Nickel CEO Chris Showalter. Report by @whitehouse789.https://t.co/xB9Euwkdxe

— The Africa Report (@TheAfricaReport) April 4, 2022

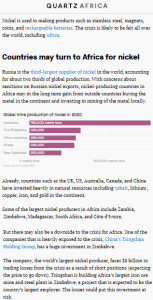

Russia is the third-largest supplier of nickel in the world, accounting for about two thirds of global production. https://t.co/Nc2uuKjdFd

— Quartz (@qz) March 27, 2022

Biden signs bill to suspend normal trade status with Russia

For metals, duties on US imports from Russia and Belarus could be raised up to 18.5% for most unwrought aluminum, 100% for #magnesium, 45% for cobalt alloys, 25% for nickel sulfate, and 20% for…https://t.co/YXEmWY0Nhk— Martin Tauber (@tauber_martin) April 12, 2022

Rosbank will rejoin the business empire of Vladimir Potanin, the 61-year-old head of mining giant Norilsk Nickel. https://t.co/sQlOZeeye9

— Rappler (@rapplerdotcom) April 12, 2022

The Russia-Ukraine war has been the catalyst for skyrocketing prices for nickel, a key material for EV batteries. https://t.co/jb0uqqdLKA pic.twitter.com/QpXrLgk9L5

— Csenge Advisory Group (@CsengeAdvisory) April 13, 2022

The massive rise in the price of #nickel has sent shockwaves through the global steel industry but it is forcing manufacturers of #electriccars to figure out alternative sources of finished nickel other than #Russia, explains @kushanmitra. https://t.co/7lAHNUHV1E

— ORF (@orfonline) April 12, 2022

Russia’s invasion of #Ukraine has added an extra layer of uncertainty to global markets. Specifically, the conflict has greatly impacted the #nickel industry– a key component of stainless steel. Learn more:https://t.co/6T14liOPV3#stainlesssteel #supplychain #russia pic.twitter.com/OEixm2Teq5

— Brennan Industries (@BrennanInd) April 8, 2022

#BMN EU authorities have JUST published the fifth package of sanctions against Russia

The new measures prohibit access of Russian vessels to the European ports

'can seriously hit the Russian exports of Ferroalloys and metals including nickel, chrome and vanadium'

That's huge! pic.twitter.com/8UDLCj4WsH

— AimWarrenBuffet (@AimWarrenBuffet) April 7, 2022

Key parts of electric vehicle batteries utilize nickel and cobalt, which typically come from Russia, China and other countries. Biden now wants to boost domestic supplies of the minerals: https://t.co/qnRFhfB3tL pic.twitter.com/Net1Tj882J

— Marketplace (@Marketplace) April 7, 2022

Analysts adjust higher #Metal price assumptions on Russia-Ukraine conflict https://t.co/7Ww0hj1jm6 via @mining #Coal #Copper #Gold #Nickel #Zinc

— Cellar Politics® (@CellarPolitics) April 7, 2022

Why rise in nickel price due to Russia-Ukraine war casts shadow on shift from fossil fuels to EVs@NikhilRampal1 reports for ThePrint https://t.co/dAraHojQMV

— Shekhar Gupta (@ShekharGupta) April 5, 2022

Nickel is a key metal for EV batteries, and because Russia is a major supplier, the war has spooked the markets. Some carmakers are turning to battery formulations that leave out nickel, even though it means less driving range.https://t.co/LugcWRViKk

— Inside Climate News (@insideclimate) April 2, 2022

The war in Ukraine has renewed conversations around nickel mining in Minnesota to wean off reliance on Russia (and China). But would opening these mines (PolyMet, Twin Metals, Tamarack) actually make a difference? I looked into it for @MNReformer. https://t.co/9qOFJvsRNC

— Colleen Connolly (@ColleenMConn) March 30, 2022

Russia could also spark a conflagration because of the awkward timing of the crisis and the impact on central banks.

The war has rattled supplies of staples such as potash and nickel from producers Russia and Ukraine, worsening the inflation outlook https://t.co/odgQpWK8E3 pic.twitter.com/xkwli5KWmb

— Financial Times (@FinancialTimes) March 30, 2022

Canada and Russia are among the world’s largest producers of crude oil, uranium, nickel and potash and, with Ukraine, wheat exports. Amid war and sanctions on Russia, “The whole world is coming to Canada.” By @jacquiemcnish & @vipalmonga https://t.co/KqI7ebBDmw via @WSJ

— Greg Ip (@greg_ip) March 29, 2022

Russia is one of the world's biggest producers of nickel ore, a key component of batteries for electric vehicleshttps://t.co/pu0NUJ9e3e

— WION (@WIONews) March 27, 2022

Vale signs deal to supply nickel to Europe's Northvolt for its batteries – says its carbon footprint of 4.4 tonnes of CO2 per tonne of nickel. That compares to around 8 tonnes CO2 for Russia's Nornickel, and much higher for nickel matte produced in Indonesia. pic.twitter.com/knu5xg7elT

— Henry Sanderson (@hjesanderson) March 22, 2022

Eye on Lithium: Will the Russia nickel crisis spark an EV demand-pivot to lithium ferro-phosphate? – https://t.co/RkwMurauta pic.twitter.com/B8nbz7X46X

— Stockhead (@StockheadAU) March 21, 2022

https://twitter.com/YusufDFI/status/1505748722948644865

Nickel prices, already hot before Russia’s invasion of Ukraine, surged after the West imposed sanctions on Russia https://t.co/yFG5c335GW

— The Economist (@TheEconomist) March 21, 2022

Russia is a military superpower, but its economic footprint is small (about 2% of global GDP), though it does punch its weight on natural resources, as a leading produce of oil/gas, coal, nickel and iron ore. https://t.co/PNkEWIY8xy pic.twitter.com/rSdTc3E57r

— Aswath Damodaran (@AswathDamodaran) March 19, 2022

#nickelmania

"In the U.S., Americans are heading into banks asking for hundreds of $ in nickels.

Russia supplies more than 20% of the world’s high-quality nickel, a crucial component in everything from stainless steel to pipes to electric car batteries."https://t.co/Ay8uZJGZM1 pic.twitter.com/jtVFwVQiTd— Brock Pierce (@brockpierce) March 19, 2022

A chain of extreme events — and repeated blunders — sparked by Russia’s invasion of Ukraine upended the nickel market and created an existential crisis for the London Metal Exchange https://t.co/WE5iZhD9uO

— Bloomberg (@business) March 18, 2022

Breakingviews – Nickel gets nixed, French firms linger in Russia: podcast https://t.co/G6IcPuLQY9

— Reuters (@Reuters) March 17, 2022

#Commodity corner: #BHP #GLEN #VALE

Rather than its better known EV bed-fellows #Cobalt & #Lithium, it appears the greatest demand for battery metals will be for #nickel.

Which is good for the world's top 5 miners: @valeglobal , @Glencore, @bhp, Jinchuan & @Norilsk_Nickel pic.twitter.com/FO4qGQqSR4

— PMH Capital (@CapitalPmh) December 3, 2021

#MetsoOutotec to modernize @Norilsk_Nickel's #smelting line in #Russia: https://t.co/QR0PTxMawS pic.twitter.com/tnEhMtbRyY

— Metso Outotec (@MetsoOutotec) December 17, 2020