All the below links and excerpts (incl pictures) are in English.

THE TRANS-PACIFIC PARTNERSHIP AGREEMENT: BENEFITS AND CHALLENGES FOR CANADIANS (PDF; 04/2017) | Standing Committee on International Trade, Canada

pp8-11 GOVERNMENT CONSULTATIONS

Consultations Prior to the Conclusion of the Trans-Pacific Partnership Negotiations

Consultations Since the Conclusion of the Trans-Pacific Partnership Negotiations

pp11-16 EXPECTED IMPACTS OF THE TRANS-PACIFIC PARTNERSHIP ON CANADA

Expected Overall Benefits for Canada of the Trans-Pacific Partnership

Many witnesses representing Canadian businesses said that, among the TPP countries, the most significant market access opportunities for their sectors would be in Japan. In addition, the Cross-Border Institute mentioned that, “[w]hile Japan is now a slow-growing economy, it’s very large, and its potential for trade expansion with Canada is great.” According to it, the reductions in Japan’s import tariffs that would result from implementation of the TPP could reduce Canada’s trade deficit with that country.

… Similarly, the Saskatchewan Trade and Export Partnership claimed that a failure by Canada to ratify the TPP could result in a lost opportunity to obtain preferential market access to countries that might accede to the TPP in the future, such as China, India and Indonesia.

… The Greater Saskatoon Chamber of Commerce said: “Should Canada choose to extricate itself from this agreement, we find ourselves in a position where it will be, over a period of time, more difficult for us to even access … traditional markets, let alone expand the opportunities and the productive capacity of this amazing region.” The Board of Trade of Metropolitan Montreal told the Committee that, “[i]f the U.S. has a competitive advantage … and we have no such advantage, we are affected, as in the case of South Korea when the U.S. signed an agreement with that country. …

Expected Overall Costs for Canada of the Trans-Pacific Partnership

… the Canadian Centre for Policy Alternatives considered that, because tariffs on Canada’s imports from TPP countries with which it does not yet have an FTA are higher than those on its exports, the TPP would likely increase Canada’s trade deficit with those countries.

… the United Steelworkers stated that the TPP would reduce the wages of Canadian workers “by putting them into competition with poorly paid foreign workers … [working in Canada] and abroad.” Global Affairs Canada provided the Committee with a different perspective, claiming that foreign professionals who would come to Canada as a result of TPP commitments “would have to be paid the prevailing wage in Canada, in that region, for a professional at that level of expertise and experience.”

… a brief submitted to the Committee by the Niagara Regional Labour Council mentioned that “provisions contained within the TPP will lead to thousands of lost jobs, higher levels of unemployment, and stagnating wages, meaning that inequality will continue unabated.”…

In addition, many witnesses believed that the TPP would increase corporate influence on Canadian public policy. … However, Global Affairs Canada provided a different perspective in remarking that provisions in the TPP would reinforce the right of member countries to “regulate in the public interest.”

Modelling the Economic Impacts for Canada of the Trans-Pacific Partnership

… Global Affairs Canada … If Canada were not to participate in the agreement, and the 11 other countries were to implement it, the study projects GDP losses of $5.3 billion by 2040.”

… the Business Council of Canada referred to a study released by the U.S.-based Peterson Institute for International Economics that suggested that the TPP would increase Canada’s national income by $37 billion by 2030. The Canadian Chamber of Commerce commented that economic impact assessments have estimated the economic benefits for Canada of joining the TPP to be between $5 billion and $10 billion annually.

… C.D. Howe Institute, Dan Ciuriak… estimated that the TPP would lead to a “modest”GDP gain for Canada of about 0.07% by 2035, which would generate household income gains of approximately $3 billion.

Tufts University’s Jeronim Capaldo, who is one of Mr. Izurieta’s co-authors … claimed that Global Affairs Canada’s economic impact assessment made an assumption about the level of employment that would occur following the TPP’s entry into force, instead of directly modelling the TPP’s effects on Canadian employment. According to him, Global Affairs Canada’s assumption about full employment is unrealistic …

pp17-19 RATIFICATION OF THE TRANS-PACIFIC PARTNERSHIP

The Alberta Beef Producers said that the Government should ratify the TPP quickly in order to “continue momentum towards implementation of the agreement more broadly.”In addition, the National Cattle Feeders’ Association indicated that “the argument can be made that Canada should ratify the TPP before the U.S. in order to make it easier to resist American efforts to extract more concessions from Canada.”

… The Canadian Chamber of Commerce contended that it would be catastrophic for Canada not to ratify the TPP if its NAFTA partners do so.

… the National Cattle Feeders’ Association claimed that, if the United States does not ratify the TPP, Canada should conclude a bilateral agreement with Japan that would “salvage” what it hopedwould be accomplished in the TPP, and that “would put Canadian producers back on an even playing field in the Japanese market with producers from countries which already have FTAs with Japan.”…

pp19-20 FEDERAL SUPPORT FOR CANADIAN BUSINESSES

… The Mining Association of Canada suggested that the Government include a northern-specific fund within Canada’s proposed infrastructure bank. In its view, this fund should be based on the Alaska Industrial Development and Export Authority model, which it characterized as highly successful.

… the Canadian Federation of Independent Business indicated that “many smaller companies don’t really know much about [the] TPP.” Similarly, Canadian Manufacturers & Exporters stated that “[t]he vast majority of smaller companies in Canada would have no clue about what the [TPP] is.”

pp21-22 TRADE IN GOODS

… some witnesses from the automobile manufacturing sector, as well as those representing Canada’s supply-managed agricultural sectors, said that these sectors would experience new import competition or would lose domestic market share as a result of the TPP’s tariff and quota provisions. Unifor commented that, “[w]ith elimination of the tariffs and lowering of the [rules of origin] thresholds, our supply jobs and assembly jobs are not only going to be threatened by the TPP players, but they’re also going to be penalized by non-TPP imports from China, from Malaysia, and from other countries around the world that aren’t even a part of the TPP agreement.” Similarly, Dairy Farmers of Canada …

pp22-32 Agriculture and Agri-Food

… the Canadian Cattlemen’s Association estimated that the TPP would allow beef producers to double or nearly triple the value of Canada’s beef exports to Japan. According to the Saskatchewan Cattlemen’s Association, such an increase in beef exports could create between 5,200 and 5,400 jobs in Canada.

The Canadian Pork Council noted that, according to a study that it commissioned, the TPP’s new market access opportunities would increase the value of Canadian pork producers’ exports by an estimated $300 million, and would create 4,000 new jobs …

Regarding Canada’s beef sector, the Canadian Cattlemen’s Association indicated that, “[w]ithout the TPP or a bilateral agreement with Japan, Canada will likely lose around 80% of the value of our [beef] exports to Japan.” The Canadian Pork Council commented that the Japanese market for Canadian pork would be lost, and that damage to Canada’s pork sector would be “extreme,” if the TPP enters into force without the participation of Canada. Cereals Canada said that “being left out of a ratified TPP agreement could result in a 50% reduction in Canadian wheat exports to the [Asia-Pacific] region,” while the B.C. Seafood Alliance stated that it would be “disastrous” for its members …

According to Chicken Farmers of Canada, the TPP would open the Canadian market to an additional 26.7 million kilograms of annual chicken imports, leading to an estimated loss of 2,200 jobs and a reduction of about $150 million in Canada’s GDP. Similarly, Les Eleveurs de volailles du Quebec said that the TPP would increase import access to the Canadian chicken market from 7.5% of domestic production to 9.6%. …

Dairy Farmers of Canada noted that the TPP would increase import access to Canada’s dairy market by between 3.37% and 3.97% of the country’s annual dairy production …

… the Canadian Cattlemen’s Association explained that, because of the 2015 Japan?Australia Economic Partnership Agreement, Japan’s tariff on Canadian beef is currently higher than its tariffs on Australian beef. It stated that, if the Government does not ratify the TPP, the discrepancy between Japan’s tariff on Canadian beef and its tariffs on Australian beef would widen due to future successive reductions in the latter tariffs under the 2015 agreement.

pp32-38 Manufacturing

… According to a brief submitted by Ford Motor Company of Canada Limited, “the TPP does not deliver any incremental or meaningful new opportunities to increase Canadian produced vehicle exports by reducing tariffs in the markets that represent the overwhelming majority of new vehicle sales because the duty rate for these markets is already 0%.” Similarly, the Canadian Vehicle Manufacturers’ Association …

… Japan Automobile Manufacturers Association of Canada provided a different point of view, and denied the existence of barriers that limit Japan’s imports of foreign automobiles. According to it, North American automobile manufacturers do not produce many models of small cars, which are popular in Japan. It claimed that approximately 90% of Japanese passenger car sales are “very small cars,” with engines under 2,000 cubic centimeters; in 2014, Detroit-based companies had only 10 models in that market segment.

… for vehicles, the percentage would be 45%. In contrast, the assessment notes that NAFTA requires at least 62.5% of an automobile’s content to originate from the NAFTA region …

… the Japan Automobile Manufacturers Association of Canada observed that eight out of every ten vehicles sold in Canada by its members are manufactured in North America, while the remaining two are imported from Japan. It remarked that “the elimination of tariffs into the Canadian marketplace will have little or no impact on the manufacturing base here in Canada.”

pp38-42 TRADE IN SERVICES

… The value of total services trade between Canada and the other TPP countries was $134.0 billion in 2014 … $58.8 billion in Canadian exports to, and $75.2 billion in imports from, those countries … 89.6% of the value of Canadian services exports to the other TPP countries was destined for the United States, while 89.3% of the value of Canadian services imports from those countries originated from the United States.

… some witnesses – including the Business Council of Canada and Scotiabank – said that financial service providers would benefit the most from the TPP. …

… the Canadian Union of Postal Workers pointed out that Chapter 10 of the TPP includes a “detailed annex on ‘Express Delivery Services’ which would impose far more explicit constraints on government authority concerning postal services and the activities of Canada Post than do those in NAFTA or the [WTO’s General Agreement on Trade in Services].” In its view, “[t]hese new rules would not only limit the ability of Canada Post to expand current services such as those of Xpresspost and its subsidiary Purolator, but would threaten its ability to maintain its current business model of integrated express delivery and letter mail services.”

pp45-51 INVESTMENT PROTECTION

pp57-61 CONCLUSION AND RECOMMENDATIONS

pp99-105 SUPPLEMENTARY OPINION BY THE OFFICIAL OPPOSITION – CONSERVATIVE PARTY OF CANADA

pp107-113 DISSENTING OPINION – NEW DEMOCRATIC PARTY OF CANADA

Canada and the Trans-Pacific Partnership: Entering a New Era of Strategic Trade Policy (PDF; 09/2013) | Laura Dawson and Stefania Bartucci @ Frazer Institute

ppiii-iv Executive summary

Canada’s trade rules and procedures are already strongly aligned with those of the United States and, as such, implementation of the TPP should not be costly. There has been much speculation as to whether Canada’s participation in the TPP would require us to dismantle our supply management system for dairy, poultry, and eggs. However, with Japan’s entry into the TPP negotiations, the odds for countries wishing to exempt sensitive sectors from TPP disciplines may improve: Japan’s protective policies for its domestic rice sector are well known and unlikely to be dismantled. If its rice protections remain, this will open the door for other members to shield their sensitive industries.

Canada gains from the TPP not only by expanding its economic partnerships but also by playing a significant role in shaping the rules that will govern trade relationships in the twenty-first century. …

pp6-7

Figure 6: Canada’s exports to top five trading partners, 2012 (billions of $CA)

Figure 7: Canada’s exports to top TPP countries, 2012 (billions of $CA)

p10 Figure 8: Overlapping rules of origin: the “noodle bowl” of trade agreements

p11 … Figure 9 shows that countries such as Vietnam, China, Mexico, and Peru still have significant barriers to foreign trade, though Mexico, which has had a comprehensive free trade agreement with the United States and Canada since 1994, has shown consistent improvements in its trade and investment rankings. …

p14 There has been much speculation as to whether Canada’s participation in the TPP will require the dismantling of Canada’s supply management system for dairy, poultry, and eggs. As Canada was negotiating entry into the talks in 2010, messaging from the United States and New Zealand indicated that Canada’s dairy exceptions were keeping it out of the negotiations (see, for example, Inside US Trade, 2010). However, the entry of Japan into the TPP negotiations probably improves the odds for countries wishing to exempt sensitive sectors from TPP disciplines. Japan’s protective policies for its domestic rice sector in the name of food security are well known and unlikely to be dismantled. As a wealthy and attractive market (currently the third largest in the world), Japan may have enough leverage in the negotiations to maintain its agricultural protections in spite of the lofty liberalization goals of the TPP. Thus, if Japanese rice protections remain, others will likely be able to shield sensitive sectors such as US sugar and Canadian dairy.

The New Trans-Pacific Partnership: Smaller, but Just as Ambitious (PDF; 16/03/2018) | Desjardins You can check out the below two pictures: GRAPH 3, 4, and TABLE 2.

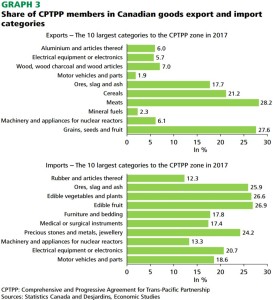

GRAPH 3 Share of CPTPP members in Canadian goods export and import categories

TABLE 1 Variation in Canadian exports by 2040 in relation to the base scenario according to various CPTPP scenarios

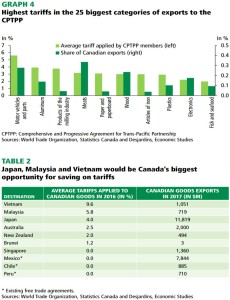

GRAPH 4 Highest tariffs in the 25 biggest categories of exports to the CPTPP

TABLE 2 Japan, Malaysia and Vietnam would be Canada’s biggest opportunity for saving on tariffs

GRAPH 5 Some products could be especially impacted by the CPTPP

THE TRANS-PACIFIC PARTNERSHIP (TPP): AN OVERVIEW (PDF; 12/2015) | John M. Curtis @ School of Public Policy, University of Calgary

Economic Impact of Canada’s Participation in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (PDF; 02/16/2018) | Office of the Chief Economist, Global Affairs Canada

Canadian industries split on new TPP trade deal (PDF; 01/23/2018) | Steven Chase and Greg Keenan @ The Globe and Mail

THE TRANS-PACIFIC PARTNERSHIP – WHAT’S IN IT FOR CANADA? (PDF; 2016) | Business Council of Canada

Give and Take – Risks and Opportunities of the Trans-Pacific Partnership for Canada’s Building Trades Unions (PDF; 08/2016) | Dawson Strategic

Gains from Trade but to Whom? – Canola and the Trans-Pacific Partnership (PDF; Fall 2016) | Hawley Campbell and Henry An @ Western Economics Forum

Trans-Pacific Partnership (TPP) (PDF; 07/2015) | CAFTA-ACCA

ACTRA SUBMISSION TO GLOBAL AFFAIRS CANADA ON THE CANADA-PACIFIC TRADE CONSULTATIONS (FORMERLY TRANS-PACIFIC PARTNERSHIP) (PDF; 10/30/2017)

POLICY BRIEF: The Trans-Pacific Partnership and Health: Potential Risks and Benefits (PDF) | Ronald Labonte & Arne Ruckert @ Globalization and Health Equity, University of Ottawa

cf.

Canada Vol.38 / Trans-Pacific Partnership #TPP Vol.4