All the below links are in English, and tweets are in Japanese.

既に2ヶ月近く経ってしまっておりますが、取り急ぎ標記につき以下貼っておきます。

Ireland Vol.37 (St. Patrick’s Day 2019 Vol.1: Republic of Ireland) アイルランドの様子

Ireland Vol.38 (St. Patrick’s Day 2019 Vol.2: Chicago, Boston, New York) シカゴ、ボストン、ニューヨークの様子

Ireland Vol.39 (St. Patrick’s Day 2019 Vol.3: United States) アメリカのその他地域の様子

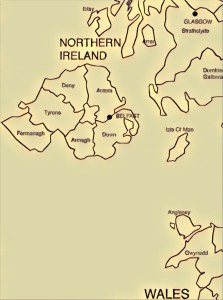

Ireland Vol.40 (St. Patrick’s Day 2019 Vol.4: Miscellaneous, United Kingdom) イギリスの様子その他

ツイートは、「セントパトリックスデー」と入れて検索して出てきたものです。

今年の #セントパトリックスデー 最後を飾るイベントです!3月30・31日は名古屋に集合!メイカーズ・ピアを会場に「アイルランド・フェスティバル2019名古屋」が開催されます!ライブやマルシェ、アイリッシュパブなどが楽しめる2日間。緑色を身につけてぜひご参加ください♪ https://t.co/pv7HY9ffDO pic.twitter.com/gvl5Va5vCh

— アイルランド大使館 Ireland in Japan (@IrishEmbJapan) March 26, 2019

アイルランド政府観光庁公式サイトのトップページが #セントパトリックスデー 仕様にリニューアル!特設ページもオープンしています。週末のイベントの予習にも、今後の旅の計画にも…ぜひ、ご覧ください!https://t.co/nJ0U8pdQBu pic.twitter.com/WArnxt3dJz

— アイルランド大使館 Ireland in Japan (@IrishEmbJapan) March 14, 2019

https://twitter.com/nikka_jp/status/1106329176934498305

https://twitter.com/MofaJapan_ITPR/status/1106480581842354178

https://twitter.com/shwanpai/status/1107027035824648192

3月17日は【セントパトリックスデー】

アイルランドの祝日で、同国にキリスト教を伝えた聖パトリックの命日が由来となっている。1903年に正式に祝日に定められ、現在アイルランドではクリスマスよりも盛大なお祭り。観光名物としても知られ、近年は日本でも普及しつつある。#今日は何の日 pic.twitter.com/RDUSOgkzMg— 地球くん (@chikyukun) March 16, 2019

https://twitter.com/hanacotoba_jp/status/1107043619716751361

昨年オープンした「クロスホテル京都」にある『キハル ブラッセリー』では、3/17まで「グリーンティーパンケーキ」がいただけます。

アイルランドのお祭り「セントパトリックスデー」にちなんだ限定メニューで、京都らしい上質な抹茶パウダーを使った一皿です。

⇒https://t.co/tmQyFwKBAP #メシコレ pic.twitter.com/e08y6QSCk9— メシコレ (@mecicolle) March 12, 2019

St. Patricks Day! #StPatricksDay #セントパトリックスデー #JPOP #tv #host #kana @AKG_information @suchmoz @KingGnu_JPhttps://t.co/ZHMt9hSQzw

— Nikkei TV (@NikkeiTV) March 17, 2019

明日は「セントパトリックスデー」

緑のものを身に着けてテレビ塔3階にお越しいただき「セントパトリックスデ!」と言うと展望入場料が半額になります。

ちょっと照れるかもしれないけど、勇気を出して「セントパトリックスデー!」とおっしゃってください!!https://t.co/nf0CopY2CZ pic.twitter.com/aBjyXtaasp— テレビ父さん (@tv103) March 22, 2019

Even robots can be #irish for a day#StPatricksFest #PaddysDay #セントパトリックスデー https://t.co/HaCe6o4p7o

— inishima #marketing (@inishima1) March 13, 2019

https://twitter.com/injwebsite/status/1106139895217577984

You posted on Instagram: 3/17 横浜マリンタワーが我々のためにグリーンにライトアップされる事が正式に決まりました٩( 'ω' )و

3/15-16は日本緑内障学会がグリーンにしてくれます。

緑内障治療中の方、ご家族にもセントパトリックスさんのご加護が届きますように〜☘☘☘#セントパトリックスデー pic.twitter.com/4eAvPDaX8Y— セントパトリックデーパレード横浜元町 (@stpd_yokohama) February 17, 2019

St Patrick's Day☘

セントパトリックスデー☘

緑のドーナツ

さて何味でしょう。笑 pic.twitter.com/qZ484ANTh8— 入江陵介 Ryosuke Irie (@ryosuke_irie) March 18, 2018