All the below links are in English. Excerpts are on our own.

PROBLEMS UNSOLVED AND A NATION DIVIDED (PDF; September 2016) | @MichaelEPorter, Jan W. Rivkin, @desaimihira, with Manjari Raman – The State of U.S. Competitiveness 2016 Including findings from @HarvardHBS’s 2016 surveys on U.S. competitiveness

抜粋・抄訳です。

EXECUTIVE SUMMARY p.2-5

Key Findings(主な調査結果)

[Chapter 1] The U.S. economy in an era of political paralysis

• Addressing America’s economic challenges requires a common understanding of competitiveness and the true underpinnings of prosperity. We define competitiveness as follows: A nation is competitive to the extent that firms operating there can compete successfully in domestic and international markets while also lifting the living standards of the average citizen. Competitiveness must lead to shared prosperity, in which all Americans have the opportunity to advance economically.

(アメリカの経済的課題に対処するには競争力についての理解を共有し繁栄の基盤を真に増強することが必要である。我々が定義する競争力とは、民間企業が一般市民の生活水準を引き上げつつ国内外の市場で競争に勝てることである。競争力は、全てのアメリカ国民が経済的に前進する機会を持つ、共有された繁栄につながるはずである。)

• U.S. competitiveness has been eroding since well before the Great Recession. America’s economic challenges are structural, not cyclical. The weak recovery reflects the erosion of competitiveness, as well as the inability to take the steps necessary to address growing U.S. weaknesses.

• Our failure to make progress reflects an unrealistic and ineffective national discourse on the reality of the challenges facing the U.S. economy and the steps needed to restore shared prosperity. Business has too often failed to play its part in recent decades, and a flawed U.S. political system has led to an absence of progress in government, especially in Washington.

[Chapter 2] Faltering U.S. economic performance

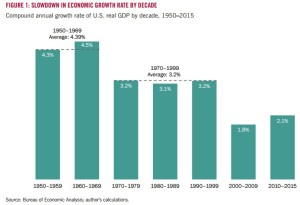

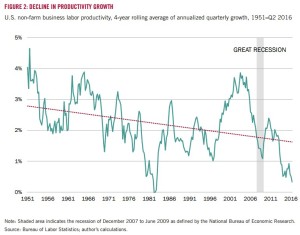

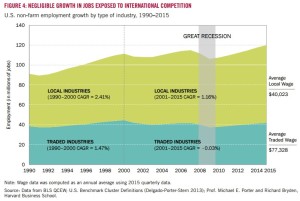

• America’s economic performance peaked in the late 1990s, and erosion in crucial economic indicators such as the rate of economic growth, productivity growth, job growth, and investment began well before the Great Recession.

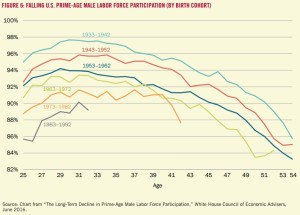

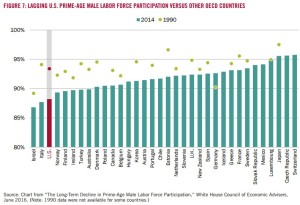

• Workforce participation, the proportion of Americans in the productive workforce, peaked in 1997. With fewer working-age men and women in the workforce, per-capita income for the U.S. is reduced.

(生産的労働力の労働参加は1997年にピークを迎えた。…)

• Median real household income has declined since 1999, with incomes stagnating across virtually all income levels. Despite a welcome jump in 2015, median household income remains below the peak attained in 1999, 17 years ago. Moreover, stagnating income and limited job prospects have disproportionately affected lower-income and lower-skilled Americans, leading inequality to rise.

(実質家計所得の中央値は1999年以来下落し、事実上全ての所得レベルにおいて停滞し続けている。…)

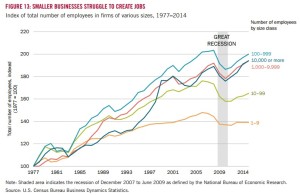

• A similar divergence of performance has also occurred between large companies and small businesses. While large firms have been able to prosper, small companies are struggling, startups are lagging, and small business is no longer the leading job generator.

(… 大企業は繁盛することができたが、中小企業は苦労し、起業者は沈滞し、スモールビジネスはもはや雇用を産み出す牽引役ではなくなっている。)

• Overall prosperity is growing slowly, but the benefits are increasingly not flowing to middle- and lower-income Americans. This puts the American Dream, or the ability of any American to advance and prosper, at risk.

[Chapter 3] An eroding U.S. business environment

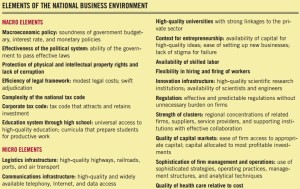

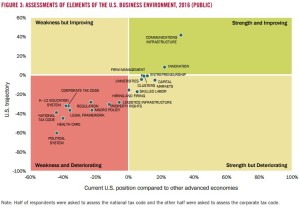

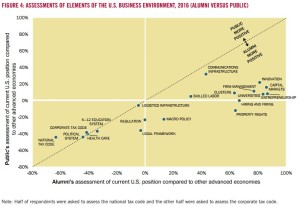

• The U.S. economy retains critical strengths. Business leaders (including HBS students) perceive strengths in areas such as higher education, entrepreneurship, communications infrastructure, innovation, capital markets, strong industry clusters, and sophisticated firm management. However, these strengths are being offset by weaknesses such as the corporate tax code, the K–12 education system, transportation infrastructure, the health care system, and the U.S. political system. Skills have also been eroding and becoming a weakness. Many of the greatest weaknesses are in areas driven by federal policy.

(アメリカ経済は決定的な強みを維持している。… しかし、…弱みに相殺されつつある。スキルも衰え弱みになってきた。多くの最大の弱みは、連邦政府の政策により運営されてきた分野のものである。)

• Alumni working in smaller firms have more negative views of the U.S. business environment than alumni working in larger firms. Members of the general public see the same U.S. competitive weaknesses as HBS alumni but, unlike alumni, perceive far fewer strengths.

• This pattern of strengths and weaknesses helps explain why the U.S. economy is no longer delivering shared prosperity. Large companies, the skilled individuals who run them, and those who invest in them benefit from America’s greatest strengths and are prospering. However, workers and small businesses are captives of the nation’s major weaknesses.

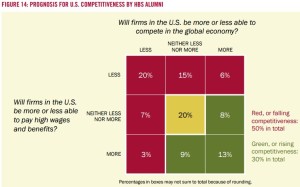

• Pessimism about the trajectory of U.S. competitiveness deepened in 2016, for the first time since we started surveying alumni in 2011. Fifty percent of the business leaders surveyed expect U.S. competitiveness to decline in the coming three years, while 30% foresee improvement and 20% see no change.

• Business leaders and the general public are particularly concerned about the future of American workers: respondents who expect lower pay and fewer employment opportunities for the average American in the future far outnumber those who expect improving worker outcomes.

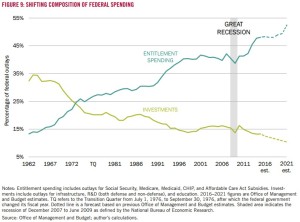

• Inadequate investment in those parts of the business environment on which middle-class Americans depend (areas like K–12 education and skills), together with lack of policy improvement in areas on which small businesses depend (tax policy, regulations, infrastructure), have undermined overall productivity and shared prosperity.

[Chapter 4] The pressing need for a national economic strategy

• Given the significant challenges facing the American economy, the U.S. needs a national economic strategy more than at any other time in recent history. A strategy is an integrated set of priorities that builds on strengths while acknowledging and tackling weaknesses. It identifies the sequence of steps needed to best move ahead.

• The U.S. lacks an economic strategy, especially at the federal level. The implicit strategy has been to trust the Federal Reserve to solve our problems through monetary policy.

(アメリカには、経済政策、とりわけ連邦レベルのものが欠けている。暗示されている戦略は、連銀が金融政策によって問題を解決してくれるのを信頼することであった。)

• A national economic strategy for the U.S. will require action by business, state and local governments, and the federal government. All three levels have a crucial role to play in restoring competitiveness.

• Taking leadership in improving U.S. competitiveness is a pressing imperative for business leaders. Many companies have failed to invest enough in improving the business environments in the regions in which they operate. Companies can have a major impact on restoring U.S. competitiveness through internal steps such as training and improving opportunities and compensation for lower-income employees. Companies must also step up their role to enhance the business environment in their communities by investing in workforce skills, supporting public education, restoring a local supplier base, and participating in collaborative economic development programs in their regions. We find growing evidence that company attitudes toward investing in competitiveness are improving and this is a welcome development. There are more and more innovative programs underway by business in skills, education, and other areas critical to competitiveness.

(アメリカの競争力を回復させるのにリーダーシップを発揮することは、ビジネスリーダーにとって緊近の責務である。多くの会社は、自分達の事業分野におけるビジネス環境への投資を十分にできていない。会社は、低所得従業員への訓練や機会・手当の改善のような社内対策を通してアメリカの競争力を回復させるのに大きな影響力を持つことができる。…)

• State and local governments must also play a crucial role in improving the business environment, because many of the crucial drivers of competitiveness are local. States and cities need a clear strategy for competitiveness rather than isolated initiatives, and government leaders should foster cross-sector collaborations among local business leaders and other community stakeholders.

(競争力の決定的な推進者の多くは地域に根差しているので、州と市等政府もビジネス環境を改善するのに決定的な役割を担わなければならない。…)

• At the state and local level, the Project has found many examples of innovative steps to enhance competitiveness. Mayors, governors, nonprofit leaders, educators, and businesses are working together in new ways to build workforce skills, invigorate the local education system, upgrade infrastructure, improve the entrepreneurial ecosystem, and develop regional economic strategies. Cities and states across America are moving forward toward competitiveness, but more can be done and best practices need to be shared.

(… 市長、知事、非営利団体リーダー、教育者、ビジネスは、労働力のスキルを創り上げ、地域の教育システムを活気付け、起業的なエコシステムを改善し地方の経済戦略を策定する新しい手法において協働している。…)

[Chapter 5] An economic strategy for Washington

• Efforts by business and state and local government to restore competitiveness cannot deliver their full promise if the federal government does not act. Many of the major weaknesses facing the U.S. are in areas controlled by the federal government.

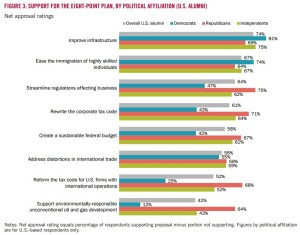

• In 2012, we put forward an Eight-Point Plan of federal policy priorities that would unlock U.S. economic growth and competitiveness. The Eight-Point Plan consists of the following policy recommendations: simplify the corporate tax code with lower statutory rates and no loopholes; move to a territorial tax system like all other leading nations’; ease the immigration of highly-skilled individuals; aggressively address distortions and abuses in the international trading system; improve logistics, communications, and energy infrastructure; simplify and streamline regulation; create a sustainable federal budget, including reform of entitlements; and responsibly develop America’s unconventional energy advantage.

(アメリカの経済成長や競争力の停滞を解き放つ連邦レベルの重点政策であるエイトポイント・プランを、我々は2012年に策定した。税率を下げ抜け穴もなくす法人税法の簡素化、他の主要国同様の源泉地国課税への移行、高度移住者の移入手続の簡素化、国際貿易における歪みや濫用への積極的な対処、物流・通信・エネルギーのインフラ拡充、規制の簡易化・合理化、福祉改革を含む持続可能な連邦政府予算の作成、アメリカのこれまでにないエネルギー優位を責任を持って創り出すこと、を提言している。)

• Each of these areas represents compelling U.S. weaknesses, primarily controlled by the federal government, that can have the most significant and near-term impact on the U.S. economy. There is also wide consensus on the policy change needed to make progress in each area. There are two other crucial U.S. weaknesses, public education and health care, but these are in fields controlled heavily at the state and local levels with no clear consensus yet on solutions.

(それぞれの分野は、アメリカの反論できないほどの弱みを表している。その弱みは、主に連邦政府に権限が握られているものであって、アメリカ経済にとって最も重要かつ近々に影響のあるものであった。また、各分野において進展させるための政策変更をしても構わないというコンセンサスがある。他に二つ、アメリカの決定的な弱みがあり、公共教育とヘルスケアである。しかし、これらは州と市等に大半の権限があるものであり、対処に係る明確なコンセンサスは無い。)

• Progress on even some of these eight priorities would transform the trajectory of the U.S. economy and the economic prospects of all Americans.

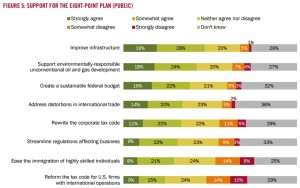

• A strong majority of HBS alumni and HBS students support all eight priorities, with consensus across all political affiliations. When asked in open-ended questions about which priorities alumni felt were most important for federal economic policy, alumni identify virtually the same priorities as those in the Eight-Point Plan. Alumni also mention education, health care, and the political system.

• In the general public survey, there was net positive support for seven of the eight priorities, with a tie on territorial taxes. Public support tended to be somewhat weaker, reflecting the fact that many in the public could neither agree nor disagree, or did not know, whether the eight priorities were good or bad for the economy. Divisive political rhetoric and an uninformed national debate have confused the average American about what the country needs to do to restore the economy. This confusion is a serious obstacle to America’s ability to make progress.

• Despite strong bipartisan support in business and net public support for the Eight-Point Plan, Washington has made very little or no progress on any of these federal economic priorities for well over a decade. The current presidential election is showing no signs of advancing a coherent plan to address these areas.

[Chapter 6] Achieving tax reform

• We believe tax reform is the single area with the greatest potential for immediate impact on the economy and is long overdue given changes in the global economy. Corporate tax policy has become a key obstacle to U.S. competitiveness and economic growth, and reforming both corporate and personal taxation is essential to achieving a sustainable federal budget.

(税制が直ちに経済に最大の可能性をもたらす唯一の分野である、世界経済の変化の下で長年の懸案である、と我々は信じている。法人税政策は、アメリカの競争力及び経済成長に対する主な障害となっている。法人税制及び個人税制の改革は、持続的な連邦政府予算の実現にとって必須である。)

• Good tax policy should be guided by the goals of increasing economic efficiency, achieving greater equity, and reducing complexity. The forces of globalization have amplified the inefficiencies and complexities of the current tax system and demand that reform make the U.S. less of an outlier in key tax policy areas – particularly corporate tax policy. Efforts to reduce the negative effects of globalization should be focused on improving competitiveness, for instance, by upgrading the skills of workers threatened by offshoring, rather than on ill-targeted tax policies.

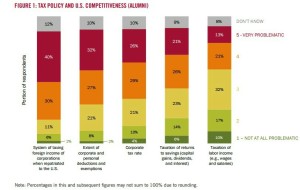

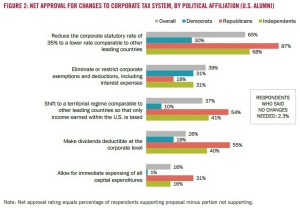

• The top corporate tax problems, according to the surveyed business leaders, are the high corporate tax rate and the taxation of international income. Business leaders report overwhelming and bipartisan support (over 95%) for corporate tax reform. Consensus corporate tax reforms include reducing the statutory rate by at least 10 percentage points, moving to a territorial tax regime, and limiting the tax-free treatment of pass-through entities for business income. The transition to a territorial regime should be complete, not half-hearted via the inclusion of an alternative minimum tax on foreign income. The feasibility of corporate tax reform is promising given the broad consensus on the nature of the problem and the required direction for reform.

(ビジネスリーダーへの調査結果によると、法人税制の一番の問題は、税率の高さと、国際的収入への課税である。法人税制改革には、圧倒的多数かつ超党派で(95%超)の支持が集まっている。法定税率を少なくとも10%下げること、源泉地国課税へと移行すること、パス・スルー法人の事業収入への免税措置を限定すること、などである。…)

• Comprehensive reform of personal taxes will be more challenging. There is less support for many types of personal tax reform. However, there is broad support for instituting a minimum tax on incomes above $1,000,000. Increasing the tax rate on savings; eliminating the deductibility of charitable giving, state and local taxes, and mortgage interest; and taxing employer-provided health insurance did not receive majority support. Respondents support limitations on deductions and exemptions in general but react strongly against them when specific examples are provided.

(個人税制の包括的改革は、もっと困難であろう。多種ある個人税制の改革には、法人税制へほどは支持が無い。しかし、100万ドル以上の所得には最低限の税を課すことには幅広い支持がある。預貯金への税率を上げること、慈善事業への寄付や州市等税さらには抵当金利への税控除を削減すること、雇用主による健康保険へ課税すること、は多数の支持を得なかった。回答者は、税控除や免除を制限することには総論賛成であったが、各論には強い反応があった。)

• Carbon, not consumption, taxes are the best step forward. Carbon taxes are remarkably popular both as a separate revenue raiser and as part of a structural, revenue-neutral reform. In contrast, consumption taxes are quite unpopular and elicit the most spirited commentary, positive and negative, from our alumni. Several recently-proposed new ideas also receive support, including taxing non-C corporation business income, raising the cap on income subject to the payroll tax, and allowing for the deductibility of dividends at the corporate level.

• HBS alumni also strongly support spending reductions as a means to fiscal stability. Nearly one-third chose not only reduced spending, but also reduced taxation. MBA students are much more accepting of tax increases and less supportive of spending cuts.

• To achieve the right kinds of tax reform, leaders must begin to speak more realistically about the fiscal realities America faces. In addition, simplistic, polarizing, and protectionist rhetoric must be avoided. The time for tax reform is long overdue.

• Tax reform can also contribute directly to shared prosperity. The earned income tax credit (EITC) is probably the single most important innovation on the personal tax side over the last two decades. Simplification and expansion of the EITC is a promising direction for reform.

[Chapter 7] A failing political system

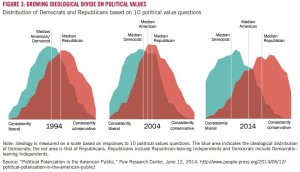

• The U.S. political system was once the envy of many nations. Over the last two decades, however, it has become our greatest liability. Americans no longer trust their political leaders, and political polarization has increased dramatically. Americans are increasingly frustrated with the U.S. political system. Independents now account for 42% of Americans, a greater percentage than that of either major party.

(アメリカの政治システムは、以前は多くの国からの羨望の的だった。しかし、過去二十年以上、アメリカ最大の負の財産となった。アメリカ人はもはや自分達の政治リーダーを信じず、政治の二極化は劇的に増大した。…)

• The political system is no longer delivering good results for the average American. Numerous indicators point to failure to compromise and deliver practical solutions to the nation’s problems. Political polarization has especially made it harder to build consensus on sensible economic policies that address key U.S. weaknesses. It is at the root of our inability to progress on the consensus Eight-Point Plan.

(政治システムは、もはや普通のアメリカ人には良い結果をもたらさない。無数の指標が示すとおり、妥協の失敗、国の問題への実際的な解決策を提供できていない失敗、がある。政治の二極化は、アメリカの主要な弱みに取り組む賢明な経済政策に係るコンセンサスを形成するのを特に難しくしている。…)

• A large majority of HBS alumni believe the political system is obstructing U.S. economic growth and competitiveness. Many alumni who self-identified as Democrat or Republican blame the other party, but a sizable proportion also hold their own party responsible.

(…政治システムがアメリカの経済成長や競争力を妨害している。…民主党員か共和党員かを自己表明していると他党を責めるが、大きな割合の者達が自党に責任があるとも考えている。)

• Among the general public, many believe that the political system is obstructing economic progress. However, many Americans are unsure, which we attribute to the divisive and partisan dialog on the economy which has confused the public on many issues.

• There is strong support for political reform among surveyed alumni. Of six common proposals for political system reform, a strong majority of HBS alumni support five. The most supported reforms are gerrymandering reform and campaign finance reform.

• Among the general public, the top two political reforms supported are term limits for the House and Senate and campaign finance reform. However, a large percentage of the general public are unsure about which reforms they favor.

• Overall, we believe that dysfunction in America’s political system is now the single most important challenge to U.S. economic progress. Many Americans are keenly aware that the system is broken, but are unsure why it is broken or how to fix it. While there is rising frustration with politics, there is, as yet, no framework for understanding the reasons for today’s poor performance and proposing effective solutions. Identifying such a framework, and the set of reforms that can change the trajectory of our political system, has become a crucial priority.

(… 政治システムが壊れている、と多くのアメリカ人が痛切に感じているが、何故壊れているかどうやって直せるかは分かっていない。政治への不満は高まっているが、今日の貧弱な成果の理由を理解し効果的な解決策を提案する仕組みは無い。…)