All the below links, excerpts, and tweets are in English.

cf.

U.S.A. アメリカ Vol.107(New York ニューヨーク州 Vol.2: pharmaceutical corporations 製薬会社)

U.S.A. アメリカ Vol.113(Massachusetts マサチューセッツ州 Vol.2: pharmaceutical corporations 製薬会社)

取り急ぎ以下貼っておきます。

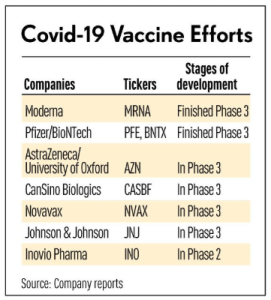

Pfizer And Moderna Face Their Biggest Challenge: Vaccinating The World (12/03/2020) | @IBDinvestors

… The obstacles can’t be overestimated, experts say. The vaccine supply chain is mindbogglingly complex. It involves local, state and federal authorities as well as hospitals, pharmacies and doctors’ offices.

The two most advanced coronavirus vaccines must be stored at specific temperatures and given in two doses several weeks apart. Stakeholders must keep tabs on who gets which vaccine and when. And don’t forget the public perception challenges of vaccinating people with drugs that went through clinical testing at record speeds.

Experts say 60% to 80% of the world must be vaccinated to achieve herd immunity. It will be many months – or years – before that happens as vaccine makers iron out supply constraints. Besides the Covid-19 vaccine companies themselves, a raft of other parties like drug distribution company McKesson (MCK) will be involved.

…the Centers for Disease Control and Prevention. The agency has overseen vaccine distribution in the U.S. for decades, including the national effort to vaccinate during the H1N1 influenza pandemic in 2009.

The coronavirus vaccination effort will probably look similar to that…

First, vaccination sites will need to enroll in the CDC’s Covid-19 vaccine distribution program. These sites will include doctors’ offices, clinics, hospitals and pharmacies. The program ensures these locations have enough well-trained staff, the right equipment and space to vaccinate large numbers of people.

Then, the vaccination sites will request doses of the coronavirus vaccine through a state agency…

Public health officials will then confirm the vaccination site is approved. If so, the order will head to the CDC. …

In August, the CDC tapped McKesson to help it distribute all coronavirus vaccines. …McKesson could rely on UPS, DHL and FedEx trucks to help it get the job done.

Pfizer, on the other hand, has a bigger challenge. The company’s coronavirus vaccine must be stored at ultracold temperatures. How cold? Penguins would find these temperatures chilly. …

Moderna’s vaccine can live in a standard refrigerator for 30 days. It can also be frozen for six months. Once thawed, providers must administer the vaccine within 12 hours – or toss it out. That creates a logistical challenge for transportation.

“Moderna will be heavily reliant on external suppliers…It will be using companies like CryoPort (CYRX), Stirling Ultracold and CH Robinson (CHRW) to work out cold chain logistics plus storage and shipping management.” …

…Pfizer has developed a special shipping container that can store the coronavirus vaccine for 10 days unopened…

The vaccine can be stored in an ultracold freezer for up to six months. It can stay in the shipping container for up to 30 days when replenished with dry ice every five days. Or, the drug can be stored for five days in a standard refrigerator.

…the strict storage requirements limit where Pfizer’s vaccine can be used. Those ultracold freezers cost about $20,000 apiece. …

…”Imagine getting one dose to Appalachia, a rural community. Now imagine having to come back and making sure everyone who got the first dose also gets the second one. That’s a challenge.”

…it’s likely the Pfizer vaccine will go to more populous locations with cold-storage capabilities. Coronavirus vaccine stock Moderna will probably send its drug to more rural communities.

…expects Pfizer to generate $875 million in coronavirus vaccine sales in 2020 and $7.25 billion in 2021. Eventually, that will trend down to $700 million to $800 million each year, depending on how often people need booster shots of the vaccine. …

“The drugmaker that gets this thing out first…Overnight, Pfizer becomes one of the most loved brands in America. It’s the McDonald’s (MCD) of the pharma industry.”

Pfizer to Ship Half as Many Coronavirus Vaccine Doses as Originally Planned in Initial Phase (12/03/2020) | @themotleyfool

…”Scaling up the raw material supply chain took longer than expected, and it’s important to highlight that the outcome of the clinical trial was somewhat later than the initial projection.”

BNT162b2, which showed an extremely high efficacy rate of 95% with no serious safety concerns in phase 3 clinical trials, has been submitted for similar approvals throughout the European Union, and with the U.S. Food and Drug Administration (FDA). In the wake of the U.K. approval, Pfizer and BioNTech anticipate decisions from other major regulators this month. …

Pfizer Scaled Back Vaccine Output Targets Earlier This Year (12/03/2020) | @business

…supply-chain problems caused the New York-based drugmaker to reduce the number of vaccines…led Pfizer shares to fall as much as 3.1% and caused the wider stock market to dip. The S&P 500 ended Thursday’s trading down 0.1%. …

Moderna Inc., which has also submitted a messenger RNA-based vaccine to the FDA for emergency clearance, said in a statement on Thursday it would have between 100 million and 125 million doses available globally in the first quarter of 2021. …

UK becomes the first to approve Pfizer-BioNTech Covid vaccine, rollout due next week (12/02/2020) | @CNBC

…with elderly people in care homes and medical workers first in line. …

“The government has today accepted the recommendation from the independent Medicines and Healthcare products Regulatory Agency (MHRA)…

Pfizer and BioNTech announced in July an agreement with the U.K. to supply 30 million doses of its mRNA-based vaccine…increased to 40 million doses in early October. As a two-dose vaccine, the U.K. will have enough doses to vaccinate around a third of its 66 million population. …

“I consider this decision to be problematic and recommend that EU Member States do not repeat the process in the same way. A few weeks of thorough examination by the European Medicines Agency is better than a hasty emergency marketing authorization of a vaccine,” said Peter Liese, a member of German Chancellor Angela Merkel’s party…

Pfizer supply chain challenges led to slashing COVID-19 vaccine production target – WSJ (12/03/2020) | @reuters,@YahooFinance

…anticipates producing 50 million doses of its COVID-19 vaccine this year. That is down from an earlier target of 100 million doses. Pfizer’s vaccine relies on a two dose regimen, meaning 50 million doses is enough to inoculate 25 million people. …

David Perdue bought Pfizer stock – a week before company said it would develop a vaccine (12/03/2020) | @salon

RT

RT