All the below links are in English.

取り急ぎ以下(内容事項一部抜粋ご参考まで)貼っておきます。

World Vol.151 (U.S., U.K., etc.)

Coronavirus … NBC10 ABC6

World Vol.150 (U.S., Australia, etc.)

ANU&UniMelb … KSTP MSPBJ

World Vol.149 (U.S., New Zealand, etc.)

AucklandUni … KTVB AFP

World Vol.146 (TorontoStar, AP, etc.)

World Vol.139 (semiconductor)

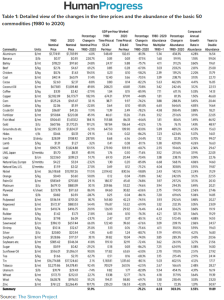

@trendforce&@CNBC,@designreuse Zippia @yahoolife @SINewsUpdates @Investopedia @rayguide @BuiltIn TechWireAsia IBDinvestors eeNewsEurope SemiEngineering 3DInCites StatistaCharts SwingTradeBot erpsoftwareblog SeekingAlpha

World Vol.137 (U.S., etc.)

China copper Israel-Palestine … NBC komonews KIRO7Seattle KSL5TV TheSun

World Vol.136 (U.S., etc.)

tax-cuts-history Wuhan … DomPost thedailybeast BBCWorld SkyNews WSJ nytimes washingtonpost

内容例(各回ツイートもご覧ください)

以下、順に、

151:@ACScowcroft @George_Friedman

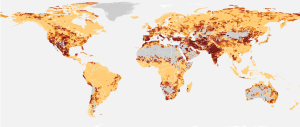

150:@crikey_news @CFR_org @StarTribune2枚

149:@TheHill @business @localnews8,@CNN2枚

147:@AFP2枚

146:@AP,@MargieMasonAP,@RobinMcDowell

139:@trendforce2枚

137:@CNBCTV18News @EconomicTimes @NBCNews

136:@HarvardPolitics

![]()

![]()